Own loans guideGetting a personal loanLoans for undesirable creditManaging a private loanPersonal loan reviewsCompare leading lendersPre-qualify for a private loanPersonal loan calculator

Using a HELOC, you usually Possess a 10-yr period of time in the course of which you pay back a little level of interest in addition to a Component of the principal monthly. If the borrowing interval finishes, you start repaying the loan. The repayment interval is mostly 10 to 20 years.

Regretably, your browser just isn't supported. Please obtain a person of those browsers for the most effective experience on usatoday.com

Travel rewards credit rating cards0% APR credit cardsCash back again credit cardsBusiness credit rating cardsAirline credit cardsHotel credit history cardsStudent credit score cardsStore credit cards

Refinancing and fairness guideToday's refinance ratesBest refinance lenders30-12 months set refinance rates15-12 months set refinance ratesBest cash-out refinance lendersBest HELOC Lenders

It’s speedy and straightforward to use, therefore you gained’t shell out fascination about the loan. In addition, there won't be any late expenses with Dave.

Urgent economic needs — commonly linked to loss of money, health care expenses, a funeral, motor vehicle repairs, vet charges or possibly a urgent residence improvement job — qualify for an emergency loan.

Why you may belief Forbes Advisor: Our editors are committed to bringing you unbiased rankings and knowledge. Our editorial written content is not influenced by advertisers.

We value your have confidence in. Our mission is to deliver visitors with precise and impartial facts, and We have now editorial criteria in place to make sure that comes about. Our editors and reporters thoroughly point-Test editorial content material to be sure the data you’re examining is accurate.

The application method is totally online, and authorised loans can be funded as soon as exactly the same day.

Double and triple-Examine the phrases prior to deciding to settle for. Although you might be in the money bind (Primarily because you might be within a fiscal bind), it's important to read through the phrases thoroughly and have an understanding of every expression and issue in advance of accepting.

.social_mobile label #button Show: flex; peak: 56px; width: 56px; history: #027db7; border-radius: 100%; cursor: pointer; placement: relative; suitable: 10px; base: 0px;

Bankrate follows a strict editorial plan, to help you belief that we’re Placing your interests initially. Our award-profitable editors and reporters make straightforward and precise articles to help you make the right economical conclusions. Key Concepts

View our home buying hubGet pre-authorized to get a mortgageHome affordabilityFirst-time homebuyers guideDown paymentRent here vs purchase calculatorHow Substantially am i able to borrow home finance loan calculatorInspections and appraisalsMortgage lender opinions

Assess your options, work out simply how much it's going to Price tag and weigh the benefits and drawbacks of money-borrowing applications to make a decision should they’re very best for you personally.

Jennifer Love Hewitt Then & Now!

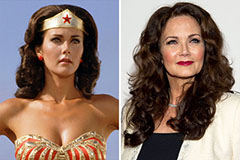

Jennifer Love Hewitt Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!